The free market operates on the principle that a good or service is worth as much as somebody will pay for it, and Lionsgate is banking on it. Analysts note that while Lionsgate-the-company is worth about $4.8 billion, the sum of its parts — Lionsgate-the-library-tv-studio-and-Starz — are worth $8.7 billion. How does that work?

To illustrate that disparity, meet the Rosenblatt Securities analyst Barton Crockett. He wrote in a Friday morning note to clients (obtained by IndieWire) that Lions Gate Entertainment Corporation as-is is worth $4.8 billion (enterprise value = market cap + debt + cash), or about half an MGM.

However, Crockett believes Lionsgate’s library alone, which includes “La La Land” and the “John Wick,” “Hunger Games,” and “Twilight” franchises, has a net value of $5.525 billion. In other words, to Wall Street, the archives are worth more than the whole company as it’s currently structured. TV production is worth another $1.6 billion, Crockett wrote, as is the entire Starz business.

After a strong Friday rally of nearly 14 percent, shares in Lionsgate Entertainment Corporation (LGF) closed at $11.57 — what the company’s studio is worth on its own, the equity analysts at Wells Fargo believe. The other half of Lionsgate, Starz, is worth just $1-$2 per share, Steven Cahall and his team wrote in a Thursday-night note to clients. (Crockett’s sum-of-the-parts valuation puts LGF at a $24-per-share price target; as-is, Rosenblatt sees a $16 future.)

All Lionsgate execs could talk about on Thursday’s conference call was the library, which generated record annual revenue of $884 million. The senior-management team even took the time the library acquisitions of Quentin Tarantino’s “Kill Bill Vol. 1, “Kill Bill Vol. 2,” and “Jackie Brown.”

By comparison, Starz is a seen by the market as an also-ran. The “Outlander” and “Power” home has been hit hard with cord-cutting, and now faces a rocky streaming ecosystem cluttered with bigger players scaling back.

An analyst on Thursday’s earnings call asked if the trend would ding the future value of Lionsgate’s library business. Executives argued that not only are there still plenty of buyers in AVOD (ad-supported video on-demand) and FAST (free, ad-supported streaming television), Lionsgate’s shelves also have enough hits to still thrive. (But, that’s also the job of a Lionsgate executive.)

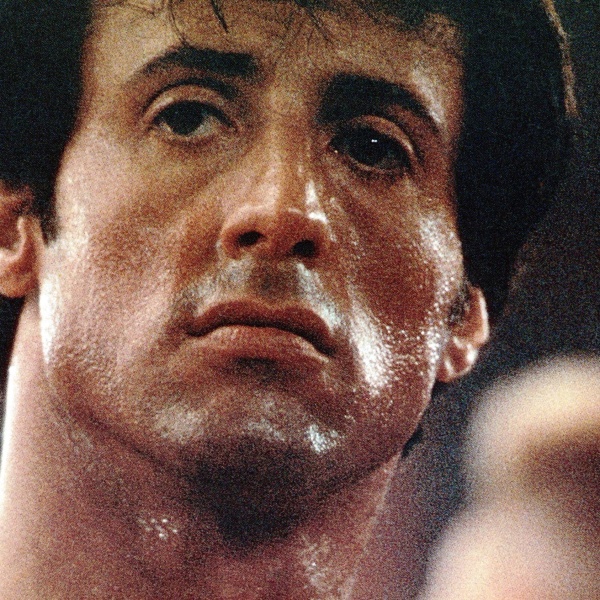

Just don’t go looking for MGM money, Cahall cautioned; beyond the draw of its “Bond,” “Rocky,” and “Creed” franchises, the M&A market “has likely cooled” since then, he wrote.

Geez, Steve, it’s the Friday afternoon before Memorial Day weekend — can we end on a positive note?

Cahall still thinks “there will be numerous parties interested” in Lionsgate’s studio. After all, it is “among the best setups in media,” he continued, making it “a likely consolidation target by larger media players.” Put another way: Who wants to stick it to Amazon? You up for it, Apple?

Additional reporting by Brian Welk.