How about a little loyalty, Max customers?

Since 2022, 31 percent of Max customers have had two or more stints (“2+ Lifetimes”) with the service, according to a study by Antenna. Here, “lifetimes” refers to the number of times an individual has subscribed to a service and canceled, with each cancellation and renewal counting as an additional lifetime.

In Max’s case, that’s 31 percent of customers who sign up, cancel, and come back later. In fact, 12 percent have stretched Max to three or more separate lifetimes in a span of two years. Warner Bros. Discovery doesn’t separate Max from HBO and Discovery+ among its direct-to-consumer numbers, but it reported last week that it has 52.6 million subscribers domestic.

Antenna says Max’s ratio of lifetimes is the most of any of the nine premium streamers it measures: Netflix, Hulu, Paramount+, Peacock, Disney+, Max, Apple TV+, Starz, and Discovery+.

Apple TV+ comes the closest to Max with 29 percent of its customers having two or more go-arounds with the service over the past two years; it’s the “Ted Lasso” & Stop method. Apple TV+ though has significantly fewer subscribers than Max, so its percentage can swing disproportionately.

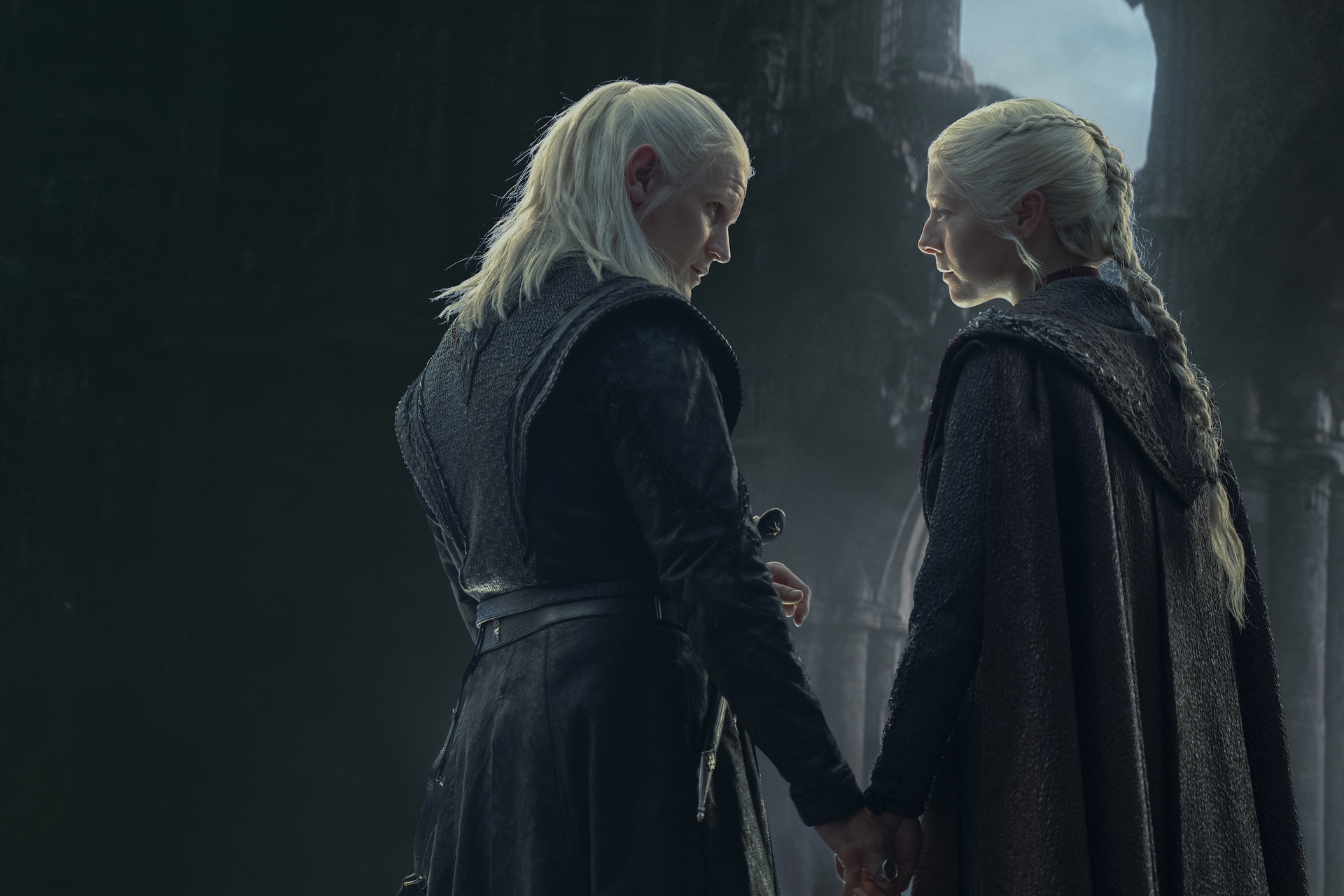

Max and Apple TV+ are both beholden to a few big-budget flagship shows like “House of the Dragon” or “Ted Lasso.” Customers tend to sign up in time for new seasons and cancel in-between. The problem isn’t unique to them, but the study suggests it hits them harder than others.

Similarly, sports-heavy services, like Paramount+ (27 percent of customers have had 2+ Lifetimes; see the bar graph below) and Peacock (28 percent), are also destined to have a lot of churn and returns.

Amazon Prime Video is not included here as most of the people with access to Prime Video are really subscribed to the greater Prime package for the free, fast shipping on Amazon.com retail products, though the reason people stick with Prime is starting to shift. Its inclusion would skew so many streaming stats — especially as they pertain to churn.

Only 11 percent of Netflix’s more than 80 million U.S. subscribers have had two or more stints since 2022. (And only 4 percent of those had more than two.) Prime Video aside, Netflix blows away the competition in customer loyalty. Its closest major competitor here, Discovery+ aside, comes from Disney: 23 percent of Disney+ customers have had 2 or more lifetimes, and 24 percent of Hulu subs have come and gone a few times.

As a whole, there were roughly 169 million gross additions across the premium SVODs between September 2023 and August 2024. A third of them (34 percent) were re-subscribers, meaning they rejoined the same service they had previously canceled within the prior 12 months.

Traditional churn rate calculations — including those by Antenna — do not take re-subscriptions into account. (It’s simply: Number of Cancellations in a Month divided by Total Number of Subscriptions in Prior Month.) But Antenna’s alternative Net Churn number does consider re-subscribers. That formula is Number of Cancellations in a Month minus Number of Re-Subscriptions in the Same Month. That difference is then divided by Prior Month’s Total Subscribers.

In all, the average gross churn rate among all the SVODs is 5.2 percent, but the weighted average is just 3.5 percent. Hollywood would love to reduce churn, but it would really love to get you to stop leaving before coming back.