“Motherfucker.” That is the first word of dialogue uttered in “Too Big To Fail” and it sums up the feeling for many who in the fall of 2008 watched closely as the United States came precariously close to suffering a major economic collapse unlike anything seen since the Great Depression. It was a sharp wake up call for the nation and the subject has already spawned a handful of films, notably Michael Moore‘s rushed and reactionary “Capitalism: A Love Story” and the much better Oscar-winning documentary “Inside Job.” At Sundance earlier this year, “Margin Call” premiered, going inside a fictional financial institution for twenty-four hours as they realize they are closer to going broke than they had realized and now Curtis Hanson‘s film follows. Making a perfect double bill, this film uses the book by Andrew Ross Sorkin as its source material and goes into the corridors of power at the banks and in Washington in the testy days before the unprecedented bailout was handed out to prevent a financial catastrophe.

Running crisply at just over an hour and a half, “Too Big To Fail” doesn’t waste a single frame or moment. The film kicks off with a sobering, effective credit sequence that mixes actual news footage and details how the banks and loan institutions were able to get themselves into the no-win position that they did. Starting with the Reagan administration, we see how deregulation was applied as a method to stimulate economic growth, but as we know now, that just led to politicians, banks and consumers being conveniently blinded to how reckless it all was. With banks giving loans to people with bad credit for homes they couldn’t possible afford in their income bracket — and those people ignoring the reality of their fiscal situation — the political world let it slide because it kept the stock market moving in the right direction. And as was inevitable, the gravy train emptied, the bills began to stack up and suddenly every bank was standing on a foundation made of quicksand.

It’s Dick Fuld (a delightfully smarmy James Woods), chairman and CEO of Lehman Brothers, who utters that opening curse and as you might guess, he’s under a bit of stress. Bear Stearns recently received $30 billion from the government to help stay afloat but Treasury Secretary Hank Paulson (an excellent William Hurt) isn’t eager to make it a habit to give public money to private institutions. Fuld is conflicted. He doesn’t want to see the bank go under, but he’s obsessed with keeping it at its current stock valuation. Selling it for mere pennies on the dollar of what it’s worth is out of the question, but with Barclays and Korea Development Bank sniffing around for deals, it may be the best offer he can get and the only way to save face. Meanwhile, Paulson sees the writing on the wall, and calls together an emergency meeting with the remaining, temporarily solvent institutions — Bank Of America, Merrill Lynch, CitiGroup, Morgan Stanley, Goldmach Sachs etc — to see they can collectively figure out a way to join hands and catch Lehman Brothers.

If this all sounds like a lot of back room maneuvering, well, it is and that’s precisely the point of “Too Big To Fail.” The unspoken word through the film is “containment”; keeping how bad the situation really is from the public and most importantly from Wall Street, which is as skittish as a lost kitten trying to cross a highway. Any sign of bad news and the market begins to tumble. So here we have a lot of weekend meetings, phone calls bouncing between banks, Washington and hell, even Warren Buffett (played by Ed Asner), as people scramble to figure a way out of a mess that seems to be getting worse by the hour. According to Sorkin (and in the taut script by Peter Gould) Paulson and his team sought desperately to keep a bailout option off the table. But as the problem keeps compounding and A.I.G. — who are the insurers for the bad mortgages which are the biggest source of financial instability — looks ready to crumble too, it’s just a matter of time before the outcome that we all know is coming, happens.

What keeps “Too Big To Fail” from being a dry run through recent history is its lightning pace, in which the stakes of the nation remain keenly at the forefront, and the remarkable ease with which the complexity and ins-and-outs of the wheelings and dealings are made understandable, rarely even feeling exposition-heavy. And with the capable cast in hand — which includes Paul Giamatti, Billy Crudup, Topher Grace, Tony Shalhoub, Bill Pullman, Matthew Modine, Cynthia Nixon — there is a real emotional pull as well, with a resounding feeling of frustration leading the way. Watching it all again, the hubris and arrogance of the banking institutions and leadfooted movement of Washington is astounding. At times, it seems even the government themselves are unsure of what they can legally do, given how much of a Wild West the banking industry has become thanks to the No Rules approach that led them to the current situation. Perhaps the best example is the now historically idiotic move by John McCain to suspend his presidential campaign and race to Washington to help with the crisis only to cause more damage than good in an already touchy political climate.

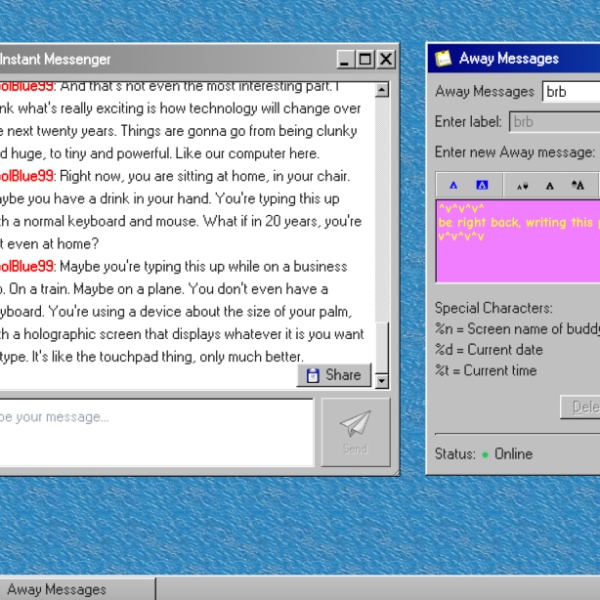

As you might be able to tell from the images, this isn’t the flashiest movie ever made. Most of the film takes place between people on cell phones or in various offices and boardrooms and while the movie itself is never dull, a certain visual stasis does set in after a while. And overall, the production is never really elevated beyond being just a really top-shelf television movie. But don’t let that put you off. “Too Big To Fail” is compelling viewing right out of the gate and at its best, feels like an insider’s tour into what really went on behind the scenes offering a different perspective to the sound bites the public was given at the time. And as the film draws to a close, an uneasy feeling sets in when you realize that the words “too big to fail” are bound to be repeated again. [B]

“Too Big To Fail” premieres tonight on HBO at 9 PM.