On April 8, 2024, a total solar eclipse will cross North America. But Hollywood executives may not be looking to the heavens — they’ll be watching David Zaslav.

April 8 is the date the Reverse Morris Trust lock-up period from Discovery’s WarnerMedia deal with AT&T expires. Put simply, it’s when Warner Bros. Discovery can again be involved in M&A activity without getting brutalized on taxes. (The Reverse Morris Trust is a method of tax avoidance that allows a company to sell off unwanted assets without incurring tax obligations on the gains from those sales.)

The otherwise random Monday, 139 days from today (2024 is a leap year!) and the day we’ll have a full sense of how Disney’s “The Omen” prequel film “The First Omen” performed over opening weekend, will be an unofficial holiday for Zaslav and his CFO Gunnar Wiedenfels. How’s that Madonna song go? “Holiday/Consolidate.”

Reflecting on his recent rounds with senior entertainment-industry leaders in Los Angeles, MoffettNathanson analyst Michael Nathanson noted in a Tuesday memo to clients (and obtained by IndieWire) there “was more discussion around the health of media companies’ balance sheets across town than we can ever remember in all of our years.” Parenthetically, he added, “probably combined.”

Piles of debt are putting pressure on free cash flow, and there is only one way out, he says: consolidation.

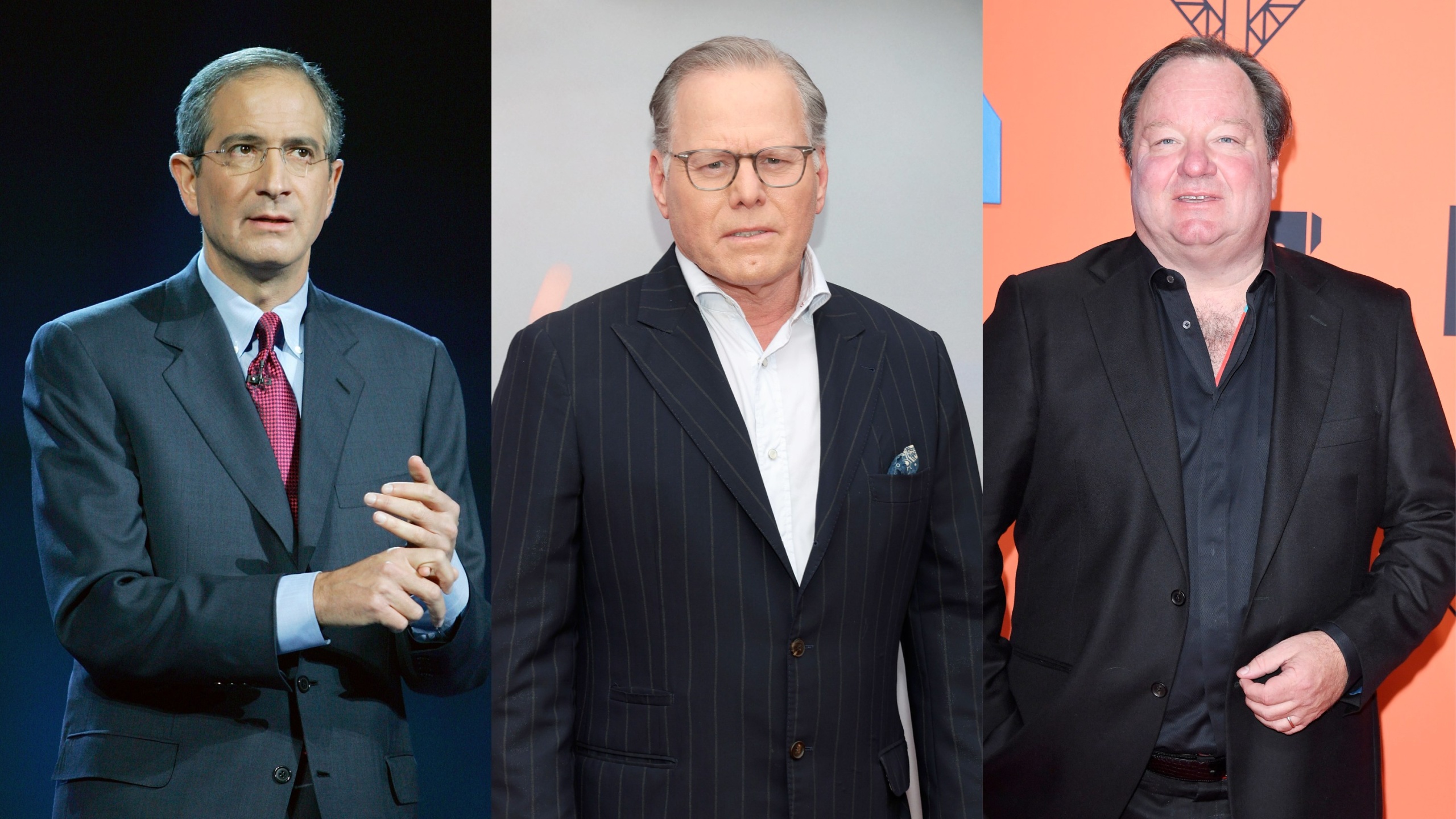

“Our conversations with Hollywood executives all reached the same conclusion of the apparent need to put many of these challenged media companies together over the next 12-24 months,” Nathanson wrote. “While most agreed consolidation would involve Paramount, Warner Bros. Discovery, (and) NBCUniversal, theories as to how specifically these three actors will marry, divorce, and intermingle their assets and management was only bound by the imagination of the presenter.”

Poetry from the number-cruncher.

Who’s got the biggest imagination? With all due respect to Netflix’s innovators and what Disney literally calls its Imagineers, the buyers will be determined “to a large degree” by one’s ties (or preferably, the lack thereof) to broadcast and cable television, Nathanson said. Strong ties to the dying medium could, at best, bind a company to another’s life raft. Hey, for shareholders, it’s better than going down with linear TV, the metaphorical sinking ship.

But before you go wrapping up Paramount Global and sticking it under a larger company’s Christmas tree next month, Nathanson says that “likely nothing will happen” before the fateful April date. (Sidebar: You known who has a huge Christmas tree right outside of its office? NBCU, owned by Comcast, at 30 Rockefeller Plaza.)

Perhaps nothing will happen for a while after April 8, 2024 either — for a while, at least. Larger economic forces, especially in the struggling advertising sector, isn’t exactly motivating the sharks (digital/tech/private equity) to feast on smaller fish. A real concern: What if advertising totallycollapses later?

“We hesitate to put too much weight on any big deal happening in 2024, especially with an unchanged regulatory backdrop,” Nathanson noted.

It is hard to get any major merger or acquisition past the SEC as it is; add the FCC in the mix, and you’ve got some real issues. To the Federal Communications Commission, two broadcast networks (i.e. NBC and CBS, in a Comcast acquisition of Paramount) cannot exist under the same roof. Unless the Dual Television Network Ownership rule is changed, one would have to be spun off and sold. It’s an extra headache that would take extra time to unwind.

“Talks of streaming partnerships might be the most realistic outcome in 2024,” Nathanson wrote.

So one major entertainment company may not buy another next year — but that doesn’t mean individual assets are off the table. Paramount Global’s apparent willingness to take bids on its Paramount studio “is always a hot topic,” Nathanson wrote.

Fellow analyst Rich Greenfield of LightShed Partners suspects the Paramount studio plus (not to be confused with just Paramount+) its lot could be worth $12 billion. But selling the Paramount studio could ultimately be a death sentence for Paramount+. Because then what’s left? CBS and MTV?

If you want to buy Paramount outright, its C-suite’s golden parachutes are suddenly feeling heavy. Just on Friday, Paramount Global recently updated its executive compensation package in the event of a sale. You know, just in case. (That’s sarcasm — the company is clearly continuing to brace for one.)

Basically it says that if Paramount is acquired and top management is let go within two years of the acquisition, they get paid-paid. CEO Bob Bakish, for example, would get like $50 million and 36 months of continued benefits.

But don’t buy that superyacht just yet, Bob.

“We don’t believe Paramount is actually for sale at this time, despite the golden parachutes,” Greenfield wrote in his own Tuesday post (shared with IndieWire). If it was, Paramount probably would be even more aggressive with the cost cutting. And oh yeah, it wouldn’t have turned down that $3 billion offer for Showtime in favor of integrating the pay-TV’s OTT (over-the-top) option into Paramount+.

“However,” Greenfield continued, “whether or not controlling shareholder and Non-Executive Chairperson, Shari Redstone wants to sell, we have a hard time seeing how a sale in whole or in pieces is not Paramount’s ultimate fate.”